The Best Deal In Programmatic Digital Advertising Right Now - Forbes

Advertisers have chased "low cost" and large quantities in digital advertising for the last 20 years. That has lined the pockets of ad tech companies small and big, like Google, Facebook, and Amazon. But has all this digital ad spending led to better marketing and more business outcomes for the advertisers? In some cases, yes. But all those who still think "efficiency" means low CPM prices and "performance" means more clicks will continue to be ripped off by ad tech vendors. Here's why.

The word "efficiency" is just a euphemism used by media agencies and ad tech companies to trick marketers into believing they are getting a good deal, covering up the fact that the only places to get "scale" (super large quantities at low CPM prices) are crappy long tail sites with low to no human audiences. Similarly "performance" and "engagement" are used by media agencies and ad tech companies to convince marketers to continue to buy; because more clicks create the appearance of more performance and engagement; conveniently many of the clicks are generated by bots, because you can't force a whole bunch of humans to click on lots of ads.

Low cost digital ads mean low low business outcomes

But marketers are finally starting to wake up to the fact that while they are getting a lot more clicks, they are not getting more sales. In fact some of those sales would have happened anyway, even without any digital ad spending. Uber found this out when they paused their digital ad spending, the app installs kept happening. The mobile exchanges Uber was paying were simply claiming credit for app installs that would have happened anyway. Other ad tech vendors in the affiliate and remarketing space are claiming credit for sales that they didn't cause or for sales that have already happened, respectively. So marketers are spending too much on digital and spending on the wrong things in digital, all of which are helping make the ad tech companies rich and helping bad guys make more money too.

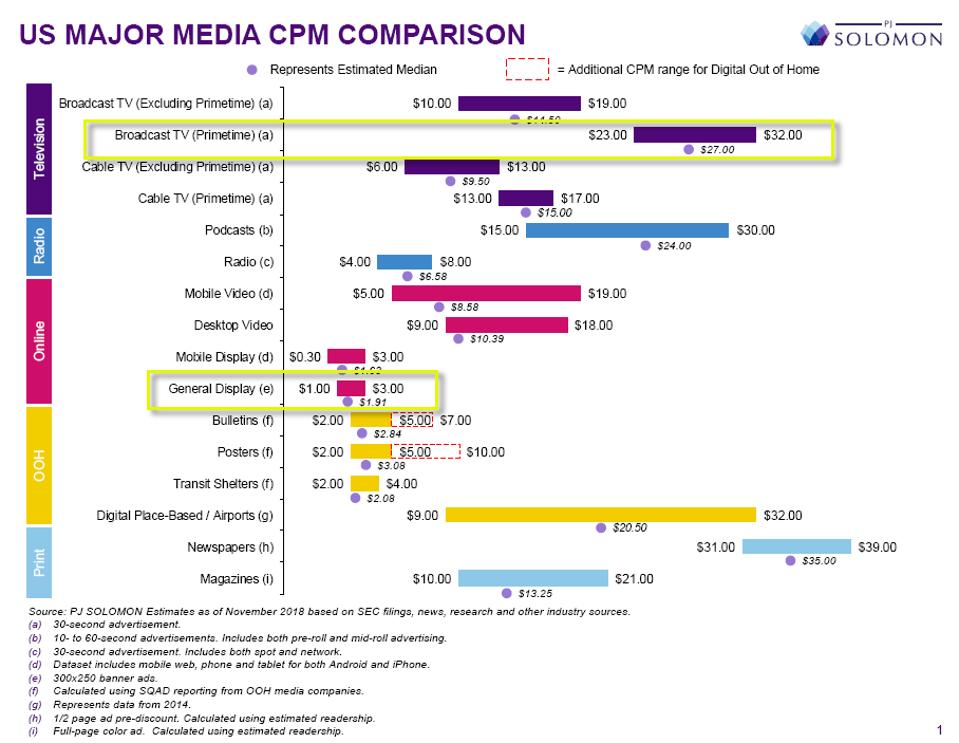

comparison of major media CPMs

PJ SolomonThe chart above compares the CPMs of various forms of media, from broadcast TV with an equivalent CPM of $30 versus digital display ads which have a CPM of $3. This is often cited as the reason marketers shifted more and more money into digital from TV. They thought they were getting better prices and greater "reach." After 20 years of this, they've become so addicted to the seemingly low prices and super large quantities of ads that they actively convince themselves that even if there is well-documented waste and fraud, it's OK — they explain "fraud is priced in, and we're getting much cheaper prices so we're OK with it." What they don't realize is that they are now buying 10X more quantity at $3. So they are still spending $30, and not really saving any money. But buying $3 inventory does mean they are buying from much higher risk sources and seeing worse business outcomes despite getting more clicks and traffic and the appearance of engagement.

Behavioral targeting is not even as good as guesswork

Furthermore, marketers have been conditioned to believe that more is better, when it comes to ad targeting; they think "more targeting parameters means more relevant ads and better marketing outcomes." Of course ad tech companies want them to believe more is better, because the more targeting parameters they add, the more profit the ad tech companies make. Advertisers bought into the concepts of hyper targeting and behavioral targeting. What they didn't realize is that the targeting parameters were mostly inferred, and therefore not very accurate. Studies have shown that the targeting data can't even get a single parameter like gender correct. The gender parameter was only accurate 42% of the time, which means a spray-and-pray campaign with no targeting at all would have hit more of the intended target audience; it would have cost less too, without the ad tech targeting fees. Sometimes ad tech data brokers mark the same cookie as both make and female so it can be sold to any advertiser, regardless of who they were targeting.

MORE FOR YOU

You paid for a whole watermelon, but only got half to take home and eat

Finally, despite years of evidence and three industry-wide studies that have consistently shown that less than 50 cents of every dollar goes towards showing ads ("working media"), advertisers keep buying through programmatic channels. In what other industry would one be OK with a 50% tax on what they buy. That's like paying for a whole watermelon, and only getting half of it to take home. So advertisers would have to spend 2X more in programmatic channels to get the equivalent "working media" as if they purchased directly from large publishers that have real human audiences. If programmatic ads only had 10% human audience, the advertiser would have to buy 10X more quantity to show ads to the same number of humans. Because of the dangers in programmatic advertising, many advertisers have been forced to pay for additional services like fraud detection, viewability vendors, brand safety tech, etc. It's all sounding like a lot of extra costs, making more ad tech vendors rich, and offsetting all those "savings" advertisers thought they were getting by buying digital ads through programmatic channels. All of these costs would not even be necessary if advertisers "bought ads as if it were 1995" — from good publishers with real human audiences — i.e. real scale, not artificially inflated "scale."

"Digitally transformed?" Now it's time to move towards greater "digital maturity"

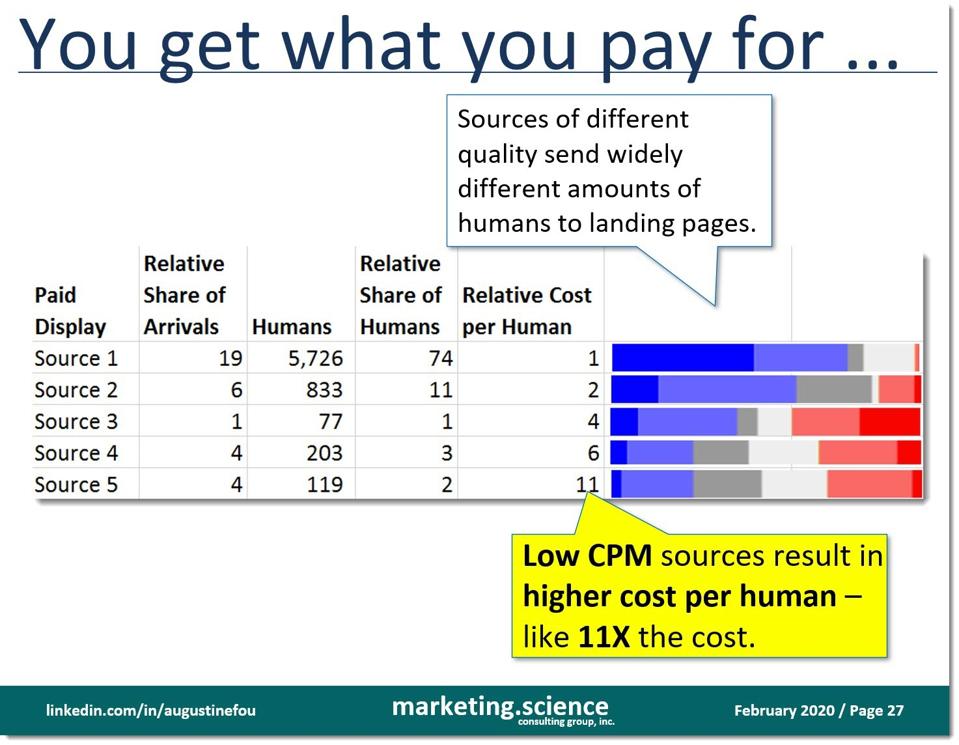

Smart marketers are taking advantage of the unprecedented opportunity to revisit "digital marketing as it's been done." They are asking for more details about where their ads actually ran, instead of just accepting monthly Excel spreadsheets that tell them how much they spent and how many impressions and clicks they got. They are asking for details about the number of ad tech intermediaries in the supply chain that were all feasting on the dollars, leaving 50 cents or less for showing ads. Some marketers are even going so far as to ask for human CPMs (hCPMs) because they know that you end up paying a lot more to get ads in front of humans if you buy in programmatic channels, sithere are so few humans looking at low cost digital ads on long tail sites.

comparison of human CPMs (hCPMs)

Augustine FouShh. Don't Tell Anyone

Marketers who are "mature" in their understanding of digital advertising are shrugging off the "demise of cookies" because they know that cookie-based tracking and behavioral targeting were so limited in its efficacy that doing away with it actually means better business outcomes, less fees paid to ad tech companies and less wasted ad budgets. But here's a secret that few marketers have taken advantage of thus far. Smart marketers are buying up as much of the "direct" inventory as possible, direct with good publishers. They do this by asking for the dealIDs of that specific publisher and the specific exchange they prefer to sell through. By buying a specific dealID, the marketer avoids problems related domain spoofing (fake sites pretending to be the domain you want to buy) and they save an average of 50% on "ad tech taxes" so more than double their money goes to working media.

Further, due to the widespread belief that no targeting parameters means worse outcomes, many immature advertisers' bidding strategies have effectively shut out Safari and Firefox browsers from bidding, because those are tracking prevention browsers. This has caused an artificial depression of CPM prices for non-tracking browsers — a literally discount of between 50 - 70%. But of course humans still use Safari and Firefox browsers; and few bots pretend to be these browsers because they can't make money from it. So savvy advertisers who target their ads specifically at Safari and Firefox browsers will be getting exceptionally good CPM prices AND show ads to humans, while saving a bundle by not having to pay for ad targeting parameters that were mostly useless snake oil anyway.

How's that for a good deal that few marketers know about, yet?

Comments

Post a Comment